With the real estate market about to heat up this spring, Zoocasa, a real estate brokerage and informaton company in Ontario, has recently released a new report showcasing what first time buyers can expect to pay when buying a house in one of Ontario’s 20 largest cities (including Brampton).

The list of cities comprises Oakville, Richmond Hill, Vaughan, Toronto, Markham, Burlington, Milton, Mississauga, Brampton, Ajax, Whitby, Waterloo, Hamilton, Kitchener, Oshawa, Guelph, Cambridge, Barrie, Ottawa, London, St. Catharines, Kingston, Windsor, Sudbury and Thunder Bay.

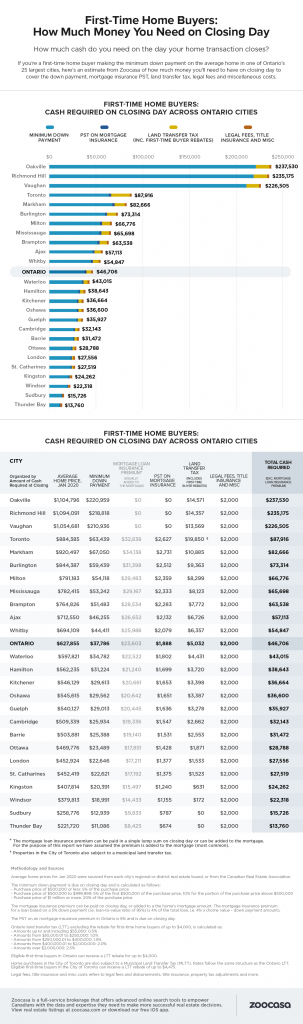

The closing costs are made up of a few different things, the bulk of which is the down payment itself. The fees also include PST on mortgage insurance, land transfer tax, insurance and other miscellaneous expenses.

Brampton, which has an average closing cost of $63,538, fares much better than Toronto which comes in at $87,916. Brampton is still above the provincial average of $46,706, though.

The most expensive? Oakville at a whopping $237,530. Oakville is closely followed by Richmond Hill ($235,175) and Vaughan ($226,505). The reason these three spots are so expensive is that the average home price is over $1 million, and for homes over a million bucks, a full 20 per cent down payment is required. Lower-priced homes can be 5 per cent or 10 per cent down, depending on the price.

A full report of how much it would cost to close on a house in each city, and a ton of other data, is located right here, but here’s the infographic to give you the overview.